Why Are Small Businesses Switching to Outsourced Accounting?

In today’s fast-paced industry, Outsourced accounting is more than just a trend. It’s the backbone of small businesses looking to scale. Especially for companies with the burden of managing complex financial tasks in-house, outsourced accounting is a game-changer. It helps businesses stay competitive, making every dollar count.

In fact, running a small business without proper accounting is like sailing a ship without a compass. You might be floating, but you will never know where you are heading. As a result, more companies are switching to outsourced accounting. In this blog, we will tell you why small business owners are making the switch.

So, let’s not waste any time and straightaway get into the million-dollar question.

Why Are Small Businesses Switching to Outsourced Accounting?

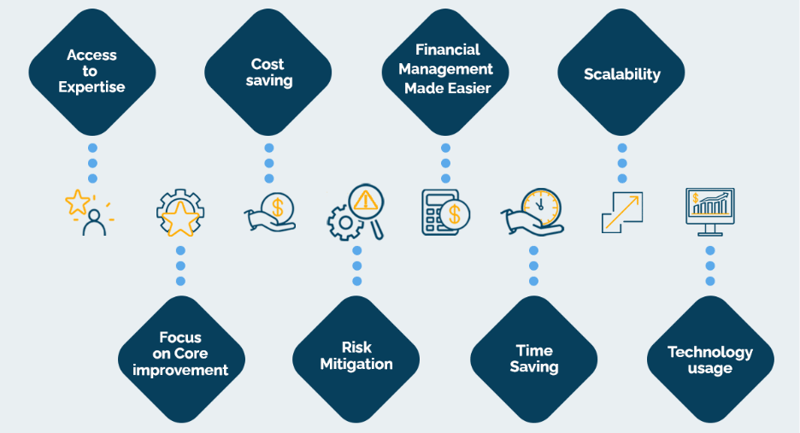

Running a small business in the U.S involves a lot of verticals, like compliance and tax regulations. While many reasons contribute to the switch to outsourced accounting, we have picked out the top 8 reasons.

-

Time Saving

-

Cost saving

-

Access to Expertise

-

Financial Management Made Easier

-

Scalability

-

Risk Mitigation

-

Technology usage

-

Focus on Core improvement

Time Saving

The value of time cannot be said in words. For small businesses, time is everything. CEOs need to juggle between spreadsheets, receipts, and complex tax forms. With outsourced accounting, professional accountants handle everything from payroll to financial reporting in real-time. This ensures business heads have ample time to focus on other requirements of the business.

Cost saving

The expenses involved in hiring full-time in-house accountants are high. You need to spend money on salaries, software, and training, etc. By opting for outsourced accounting, you only pay for the services you need. Moreover, you can access financial expertise at an affordable cost without accuracy compromise. Therefore, you are bound to have significant cost savings.

Access to Expertise

Running any business needs a team of seasoned financial experts. Their knowledge of accounting and compliance can help you make smarter decisions. Any complex report or changing regulation will make it tough and time-driven for the in-house team. Outsourced accountants have the enterprise-level expertise needed to help you at any stage of the business.

Financial Management Made Easier

Financial activities like day-to-day bookkeeping, payroll, and tax tasks can be stressful too. You might lose track of your business if the right people are not hired. Outsourcing your accounting ensures accurate deadlines are met and financial reports are always up to date. Hence, you can gain clear visibility into your business finances.

Scalability

Scaling your business can simultaneously increase your needs, too. There might be unnecessary costs or operational strain if not properly handled. As your company expands, you might need extra support during tax season or advanced financial insights. Out-sourced teams can quickly adapt to business requirements. They can scale up or down depending on the business requirements.

Risk Mitigation

Staying up to date with the latest regulations, reducing the risk of errors, penalties, or audit issues is significant in the financial industry. This ensures your financial data is handled with accuracy, compliance, and security. Your long-term financial stability could be at risk. By outsourcing, your accounting is managed by industry experts who prioritize transparency and accountability. They implement internal controls to reduce the risk involved.

Technology usage

Cloud-based dashboards and AI-powered insights have been a major technological upgrade in the financial industry. These advanced tools are known for automation, real-time reporting, and data security. Your financial operations are faster and more accurate. The software costs are high and might not be affordable for the in-house team. However, outsourced teams have access to the latest software and help you gain a competitive edge in the industry.

Focus on Core improvement

While you take care of your accounting needs, you cannot forget what truly matters first. Scaling your core operations drives your overall performance. It builds the much-needed confidence to withstand the tough competition. However, to think and meet those core needs, an outsourced accounting team can be helpful. It gives you freedom for strategic initiatives, product development, and customer engagement.

Now comes the ultimate question.

Should I outsource my accounting?

Well, outsourcing your accounting still depends on your business needs. For small businesses, outsourcing makes a huge difference straightaway. The middle and established firms might not need to urgently, but for long-term stability, they will need to outsource their accounting too. Outsourcing not only helps with scaling the business but also keeps the firm prepared for tough situations. There are numerous advantages associated with it.

Also read: How Do Outsourced Accounting services work? Process & Tools explained

Moving on, let’s find out how to pick the ideal outsourced accounting firm.

How to pick the ideal outsourced accounting firm?

Choosing an outsourced accounting firm is like planting the right roots for your business tree. The stronger they are, the healthier your growth will be. Here are a few things you should consider before picking up the ideal firm.

-

Experience and Expertise are the first things you would want to look for in an outsourced firm. You cannot buy experience, and it’s very valuable in the financial industry.

-

Ensure the firm offers personalized accounting services like bookkeeping, payroll, tax planning, and financial reporting for the clients.

-

Look for reviews and testimonials to understand their reliability. Client feedback ensures professionalism and helps in proper communication for the future.

-

Evaluate the technology they incorporate into their services. Ensure the tools they use are updated and seamless.

-

Pricing can differ from firm to firm, and transparency is key here. Any hidden costs need to be disclosed earlier by the firm.

Let’s move to the final part of the blog.

Conclusion

Having financial clarity for your business is the ultimate need of the hour. You could be scaling at a faster rate and enjoying the profits, but without proper accounting, you could be back to where it all started. By outsourcing your accounting, you can be assured that the base is all set, and it’s upon you to execute the right strategy.

If you are still confused about which type of accounting strategy can suit your business, get a consultation from a top outsourced accounting firm. They have the best solutions to all your needs and can guide you through the process. We at Tarsus have helped several startups scale and move to the next level seamlessly. Contact our experts to solve your business queries now.

Leave a Comment

Your email address will not be published. Required fields are marked *