The Real Cost Difference Between In-House CFOs and Outsourced CFOs – Which one saves you more in 2025?

In today’s fast-changing business world, companies need strong financial leadership. But that doesn’t always mean hiring a full-time, in-house Chief Financial Officer (CFO). More growing businesses are turning towards outsourced CFO services to access expert financial guidance without the heavy cost of a full-time hire.

Let’s look at the real cost difference between in-house and outsourced CFOs, what drives these costs, and why outsourcing often makes better business sense.

Understanding the Role of a CFO

A CFO shapes the financial direction of a company. They handle the entire financial essentials from budgeting, forecasting, cash flow, fundraising, investor relations, to compliance for stability and growth.

However, the way you choose to structure the role of a CFO has a big impact on your costs and flexibility.

The In House CFO: Expensive but Hands On

Hiring an in-house CFO gives you direct, full-time financial leadership. But it comes with significant costs and long-term commitments.

1. Salary and Benefits

A full-time CFO can earn anywhere from $180,000 to $400,000 or more each year depending on company size and location. When you add benefits, insurance, and bonuses, total costs can exceed $500,000 annually.

2. Overhead Costs

On top of salary, businesses pay for:

- Office space and equipment

- Finance staff to support the CFO

- Training, professional fees, and software

Tip for founders: Keep financial records auditable, consistent, and GAAP-compliant.

3. Long Term Commitment

Hiring or replacing a CFO can take months and cost thousands in recruitment fees. You also have onboarding time, notice periods, and severance costs, making it difficult for companies that need agility.

Tip for founders: Engage legal counsel early to resolve red flags before fundraising.

The Outsourced CFO: Expertise Without the Expense

An outsourced CFO gives you the same level of financial strategy and insight but at a much lower cost. You only pay for what you need, whether it’s a few hours a week or specific project support.

1. Cost Efficiency

Outsourced CFOs typically work on a flexible or project basis, costing between $3,000 and $15,000 per month, depending on the scope. Even at the higher end, this is less than half the cost of a full-time hire.

2. Access to a Full Finance Team

Most outsourced CFO providers include a team of professionals. Accountants, controllers, and analysts all work together under one package. Hence, you get a complete finance function without hiring multiple employees.

3. Scalable and Flexible

You can easily adjust the level of support as your business grows or during busy financial periods like audits or funding rounds. This flexibility makes outsourced CFOs ideal for startups and fast-growing companies.

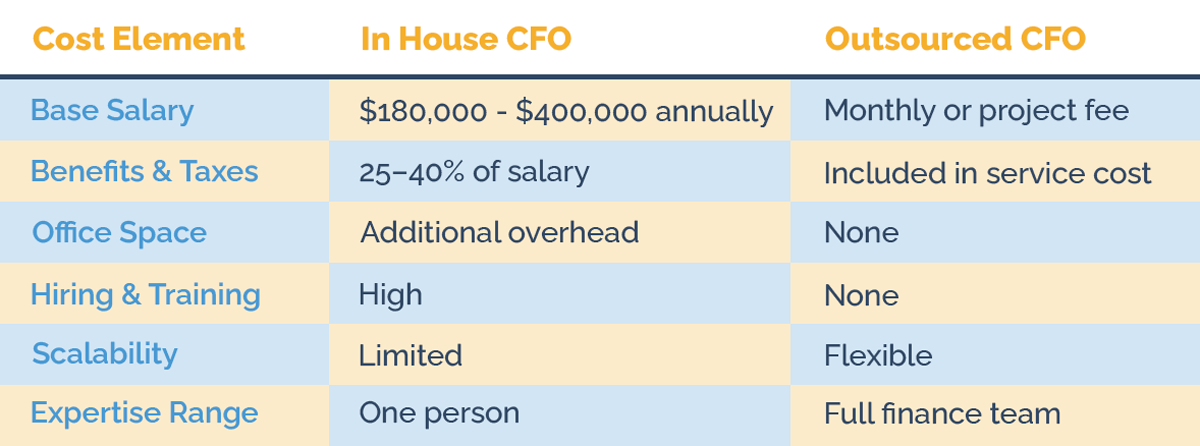

Comparing the Costs

Bottom line: Outsourcing your CFO function can save up to 60–75% of your total financial leadership costs while improving efficiency and access to expertise. Moreover, Outsourced CFO makes more sense now in the hybrid work environment too.

Key Benefits of an Outsourced CFO

Beyond cost savings, outsourcing your CFO brings several strategic advantages.

1. Broader Experience

Outsourced CFOs often work with clients across multiple industries from SaaS and healthcare to professional services and manufacturing. This gives them deep insight into best practices that can help your business grow faster.

2. Faster and More Accurate Reporting

Because outsourced CFOs work with specialized teams, they can deliver:

- Investor ready reports quickly

- Reliable, audit ready financials

- Data driven insights and analytics

3. Better Use of Technology

Most outsourced CFO firms use advanced cloud tools like QuickBooks, NetSuite, and HubSpot integrations. These tools improve accuracy, collaboration, and real time financial visibility.

4. Objective Financial Guidance

External CFOs bring an independent perspective to your business. They are not influenced by internal politics and can provide honest, data-based advice to support smart decisions.

5. Strong Compliance and Risk Control

Outsourced CFOs ensure your business stays compliant with tax regulations and accounting standards like GAAP or IFRS. They also help minimize audit findings and financial risks.

When to Choose an Outsourced CFO

Outsourced CFO services are a great fit if your company:

- Is growing quickly and needs financial structure

- Doesn’t have the budget for a full-time CFO

- Is preparing for fundraising, audits, or acquisitions

- Needs better forecasting and cash flow visibility

- Wants to strengthen reporting without expanding the team

Why More Businesses Are Outsourcing Their CFO Function

The trend toward fractional and outsourced CFO models continues to grow.

- Mid-sized companies save up to 70% annually with outsourced CFO solutions.

- Startups secure funding faster with expert investor ready reports.

- Private equity backed firms rely on outsourced finance teams for due diligence and post-acquisition integration.

A Real-World Example

A technology startup replaced its $250K per year in-house CFO with an outsourced CFO service costing $8K per month. Within six months:

- The monthly closing time dropped from 30 days to just 7.

- Reporting accuracy improved by 98%.

- The company saved nearly $170,000 in annual overhead.

That’s how outsourcing transforms financial operations faster, leaner, and smarter.

To Wrap up

An in-house CFO can be valuable for large corporations with complex structures, but for most growing companies, outsourced CFO services are a smarter and more affordable option.

With the right partner, you get:

- Strategic financial leadership

- Reliable and compliant reporting

- Major cost savings

- Flexibility to scale as you grow

Outsourced CFO services give your company the financial clarity it needs to make confident business decisions without the burden of high fixed costs.

Contact Us Today

Want to explore how an outsourced CFO service can help streamline your finances and improve profitability?

Contact us today to discuss how we can tailor a financial solution to your business needs.

Leave a Comment

Your email address will not be published. Required fields are marked *